| Single Family | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $275,000 (+4.3%) | $312,985 (+5.3%) | 1697 (-1.7%) | 2677 (-7.9%) | 96 (-1%) |

| Condo | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $228,500 (+3.9%) | $256,916 (+5.2%) | 517 (-4.4%) | 653 (-7.5%) | 88 (+14.3%) |

The ongoing story in the national and regional market is the contraction of inventory for sale, so perhaps it is remarkable that sales during the third quarter remained stable in northwestern Vermont, while inventory generally declined.

Third quarter (Q3) activity reflects properties that were put under contract in the spring, with ensuing closings in July, August and September. June is typically the top month for real estate closings, as new households form and consumers work around summer vacations to buy or sell a new home. However, over the past few years, sales have strengthened in Q3, which is evident in this report. A season of strong buyer demand this year likely contributed to a timing of transactions that produced a stable Q3.

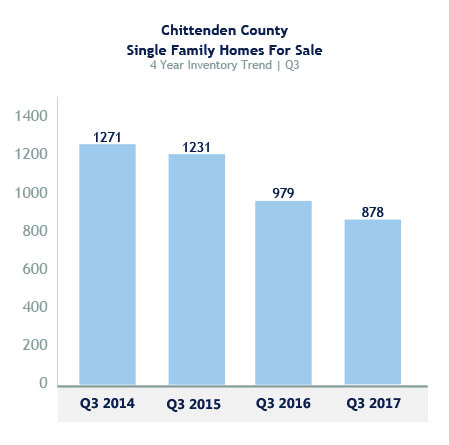

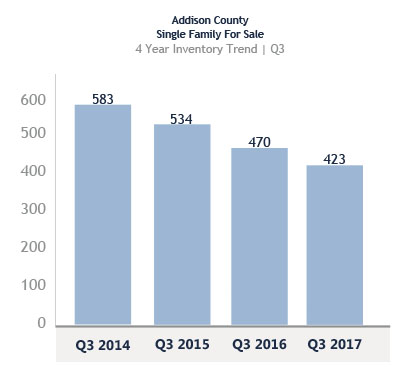

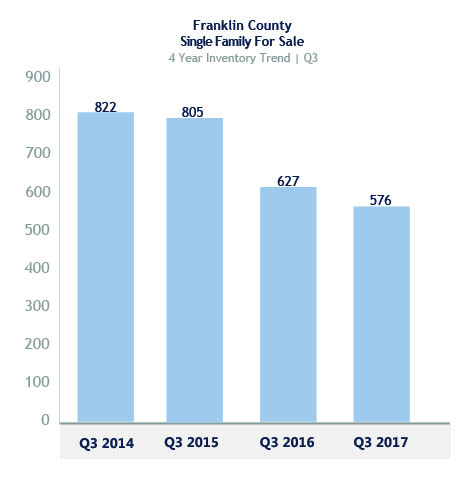

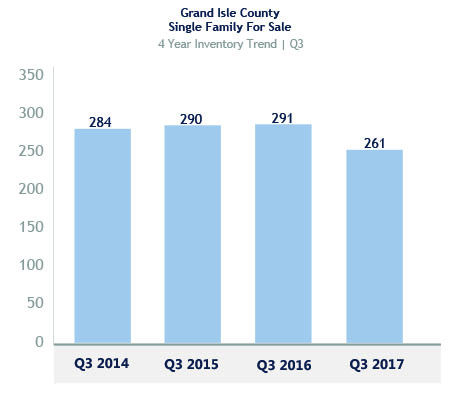

In our 4-county region, including Chittenden, Addison, Franklin, and Grand Isle Counties, the number of single-family homes for sale in Q3 was 2,138, compared to 2,367 at this time last year — a decline in inventory. However, demand remained strong. In 2016, 714 single-family homes sold between July and September; 736 were sold in Q3 2017 — a rise in sales.

The inventory of single-family homes for sale in Q3 has dropped steadily (nearly 28%) since 2014, when there were 2,960 on the market in Q3. Meanwhile, the number of single-family homes sold has increased 24.5% during that same period. Despite a strong Q3 in terms of closed real estate transactions, the YTD number of single-family homes sold in our 4-county region has dropped by 1.7%, while the number of condos sold has lowered by 4.4% — likely a result of the continuing decline in inventory.

One national and regional trend contributing to lack of inventory is simply that Americans are moving less. According to data from the National Association of Realtors, homeowners are staying in their homes for 10 or more years, compared to a previous national average of seven years.

The tightening of inventory has generated a jump in sold prices. Year-to-date (YTD), the median sale price of a single-family home — with the median price being “half the houses sold for more and half sold for less” — has jumped 4.3%, while the sale price of condos has risen nearly 4%.

The demand for homes and a shrinking stock of inventory has created an unusual number of multiple-offer situations for buyers and sellers. Buyers should consider a price point but be ready to be flexible in a competitive offer circumstance. Buyers should also enter the home buying process with pre-approval for financing from a local lender. Sellers should prepare their homes in advance for showings and inspections.

On the lending side: Mortgage rates are still low — around 3.8% for 30 years — but the national inventory shortage and an unprecedented amount of college debt facing younger generations has slowed the rate of household formation for first-time homebuyers. New lending regulations and restrictions have also posed challenges for first-time homebuyers, while Baby Boomers who are downsizing can sometimes make cash purchases. Sellers and buyers should be aware of this trend when considering multiple-offers. Our thoughtful and skilled Realtors can help with the often speedy, whirlwind competitive bidding process.

In previous years, we have witnessed that homeowners with properties on the market tend to take them off the market in the fourth quarter during the holiday season. However, if sellers are committed to selling, our agents recommend they keep their property on the market through the winter, because this is when motivated buyers, who must move for any reason, such as job relocation — are looking for a new residence.

Our team of experienced Realtors are available to answer any of your questions about the real estate market and your specific circumstances. We look forward to working with you.

The largest increase in the number of home sales can be found in Grand Isle – with an 8.7% increase year over year. However, the relatively small numbers can have a greater effect on the statistics.

The largest increase in the number of home sales can be found in Grand Isle – with an 8.7% increase year over year. However, the relatively small numbers can have a greater effect on the statistics.

Executive-level

Executive-level