| Single-Family January-December 2021 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

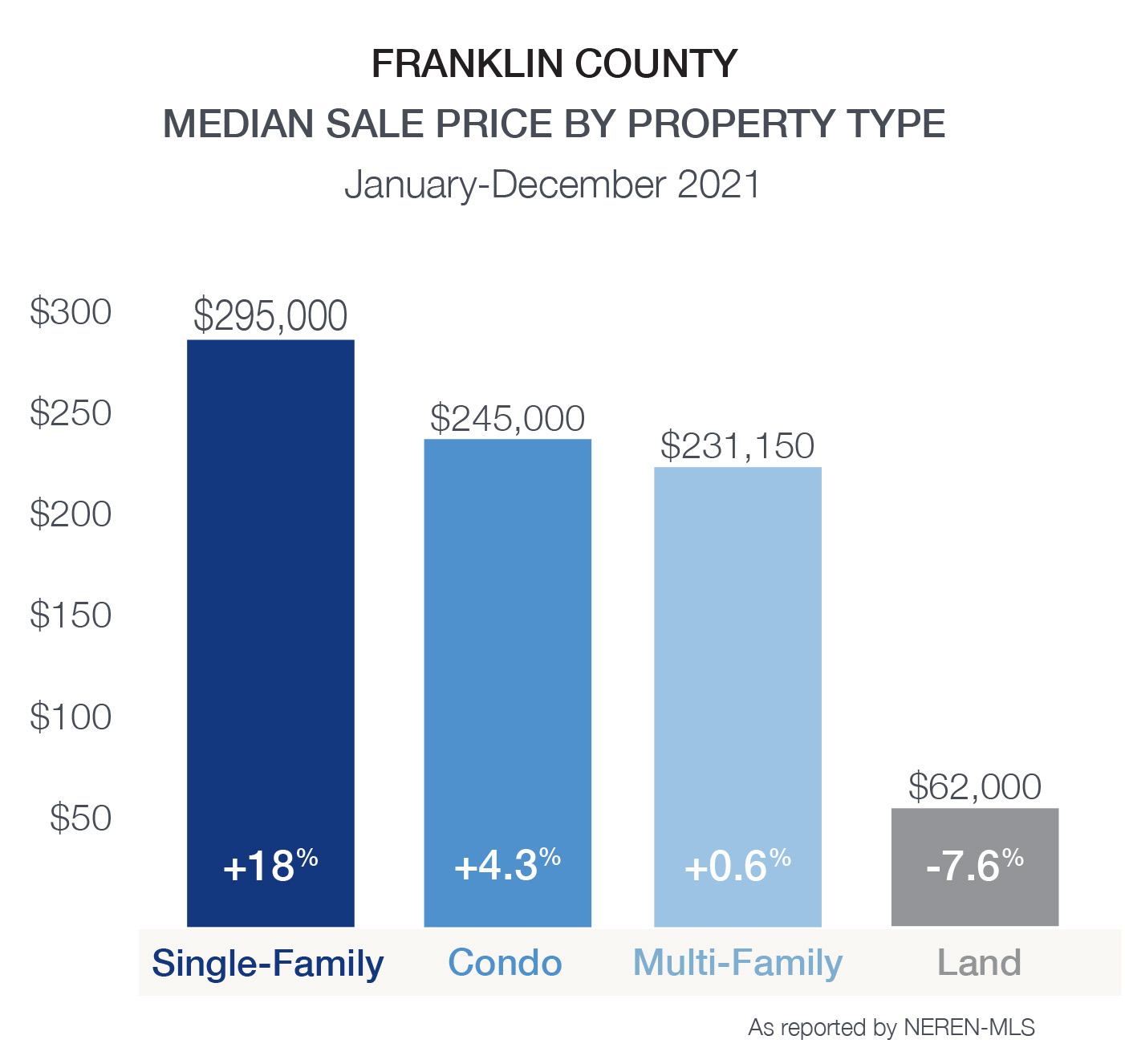

| $295,000 +18% | $309,118 +18.8% | 671 +3.4% | 727 +1.1% | 46 -43.9% |

| Condo January-December 2021 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $245,000 +4.3% | $253,311 +9.3% | 54 -26% | 84 +20% | 22 -68.6% |

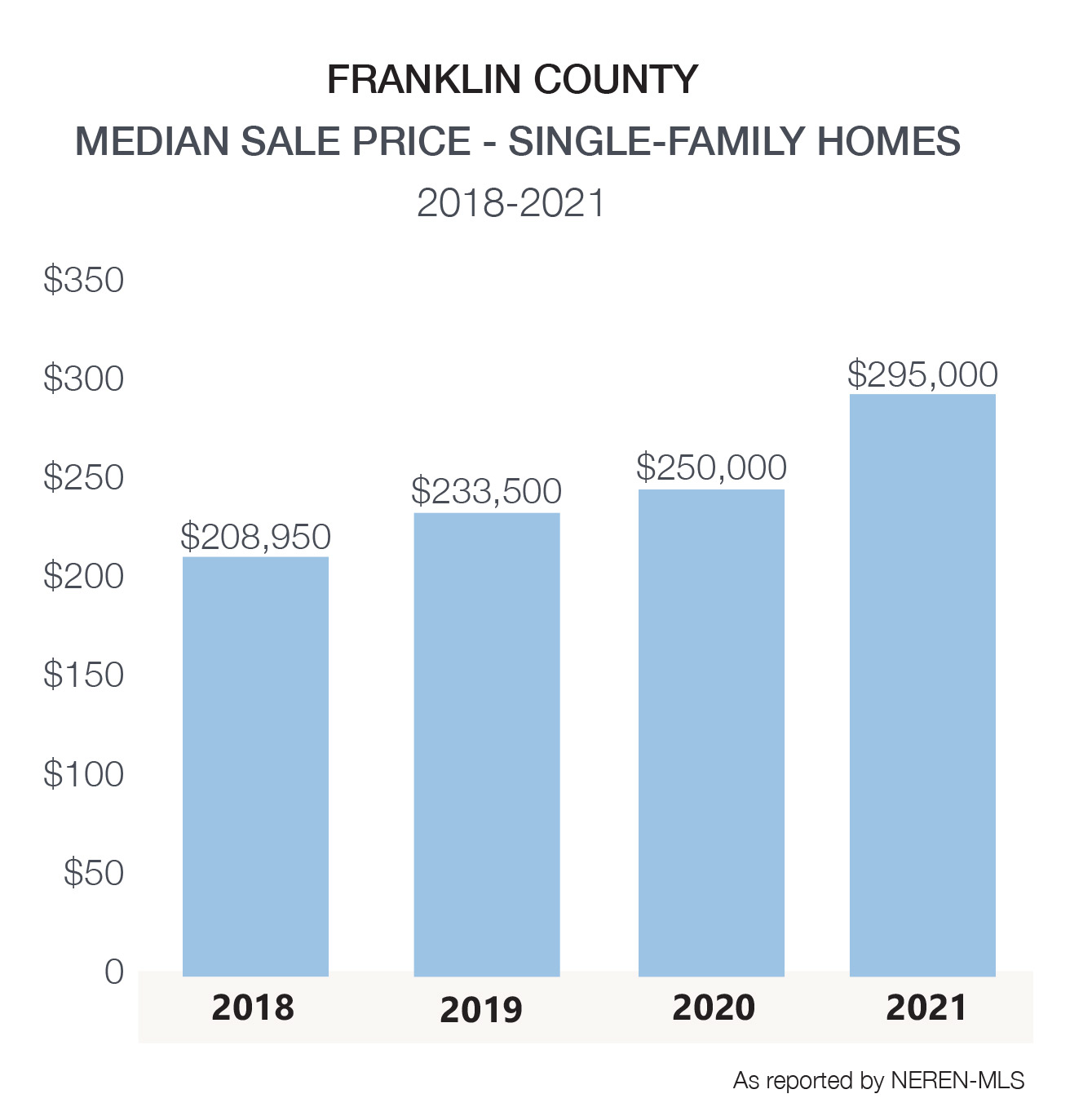

The median sale price for a home in Franklin County reached $295,000 in 2021. While the price has increased 41% since 2018, the county still provides the most affordable options in northwest Vermont. More homes were listed for sale during the first half of the year, while condos coming to market increased by nearly 20% by year end. The average days on the market dropped to only 46 days from listing to close for single family homes – so buyers need to be well prepared to act when the right property hits the market. St. Albans topped the county in sales by a large margin, followed by Swanton, Fairfax, and Georgia. The median sale price of $380,000 in Fairfax was 29% above the county average, but still 14% lower than the median price in nearby Chittenden County. With easy access to I-89, these towns provide options for buyers commuting to work. Traveling east, the towns of Sheldon, Berkshire, and Montgomery posted significant increases in the number of homes sold in 2021. Work from home opportunities as well as vacation home purchases may be part of the reason for growth in this area of Franklin County.

| MEDIAN SALE PRICE | VS 2020 | UNITS SOLD | VS 2020 | NEWLY LISTED | VS 2020 | DAYS ON MARKET | |

|---|---|---|---|---|---|---|---|

| Franklin County Single-Family | $295,000 | 18.00% | 671 | 3.40% | 727 | 1.10% | 46 |

| Bakersfield | $332,000 | 54.10% | 19 | 5.60% | 21 | -4.60% | 71 |

| Berkshire | $245,000 | 20.40% | 17 | 21.40% | 17 | -26.10% | 84 |

| Enosburg | $200,000 | 1.10% | 32 | -11.10% | 33 | 22.20% | 43 |

| Fairfax | $380,000 | 17.80% | 75 | 13.60% | 77 | -2.50% | 35 |

| Fairfield | $270,000 | -0.50% | 15 | -25.00% | 16 | 0.00% | 26 |

| Fletcher | $372,500 | 44.70% | 20 | 25.00% | 23 | 76.90% | 45 |

| Franklin | $297,500 | 15.00% | 20 | 25.00% | 21 | -8.70% | 108 |

| Georgia | $340,000 | 4.60% | 73 | 15.90% | 86 | 38.70% | 21 |

| Highgate | $267,500 | 20.20% | 30 | -42.30% | 39 | -17.00% | 8 |

| Montgomery | $240,000 | -3.60% | 27 | 42.10% | 30 | -16.70% | 144 |

| Richford | $139,500 | -6.40% | 36 | 12.50% | 34 | -12.80% | 87 |

| Sheldon | $318,000 | 38.30% | 26 | 52.90% | 27 | 3.90% | 35 |

| St. Albans | $290,000 | 13.40% | 188 | 1.10% | 194 | -9.40% | 34 |

| Swanton | $270,000 | 15.70% | 93 | -1.10% | 109 | 18.50% | 47 |

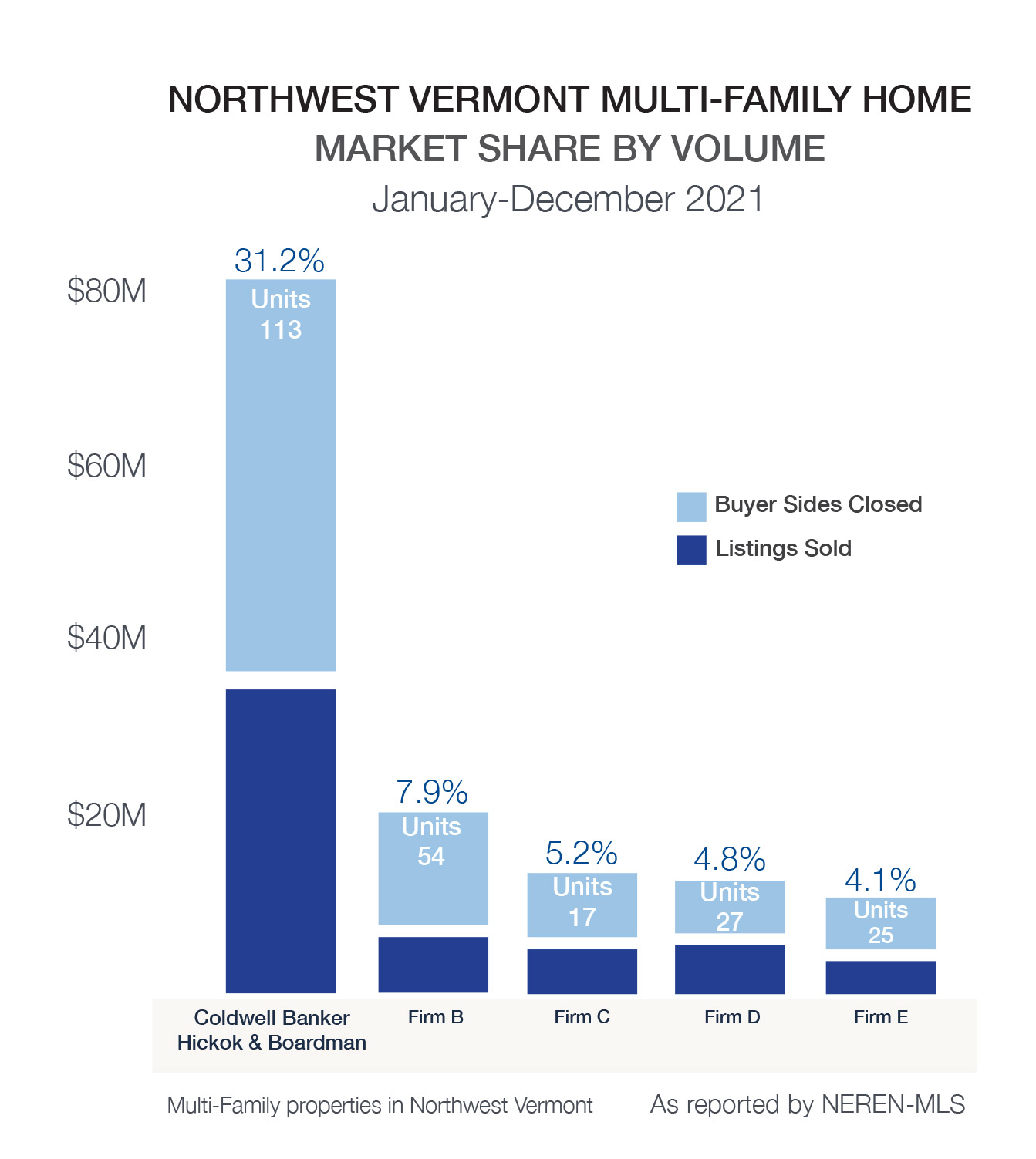

The rental vacancy rate has been reported at 0.8%, and while rental rates increased only modestly during the pandemic, rates are projected to go up locally and nationally in 2022 and beyond. Many would-be home buyers are opting to stay put in their rentals after unsuccessfully writing multiple offers for purchases.

The rental vacancy rate has been reported at 0.8%, and while rental rates increased only modestly during the pandemic, rates are projected to go up locally and nationally in 2022 and beyond. Many would-be home buyers are opting to stay put in their rentals after unsuccessfully writing multiple offers for purchases.