| MEDIAN SALE PRICE | VS 2021 | UNITS SOLD | VS 2021 | NEWLY LISTED | VS 2021 | DAYS ON MARKET | |

|---|---|---|---|---|---|---|---|

| Northwest Vermont Multi-Family | $494,500 | 19.0% | 106 | 0.0% | 142 | -14.5% | 49 |

| Chittenden County | $522,500 | 15.1% | 82 | 6.5% | 108 | -12.2% | 40 |

| Addison County | $425,000 | 4.9% | 5 | -28.6% | 15 | 36.4% | 63 |

| Franklin County | $297,000 | 31.2% | 18 | -14.3% | 18 | -37.9% | 84 |

| Grand Isle County | $385,000 | 483.3% | 1 | 0.0% | $1 | -66.7% | 29 |

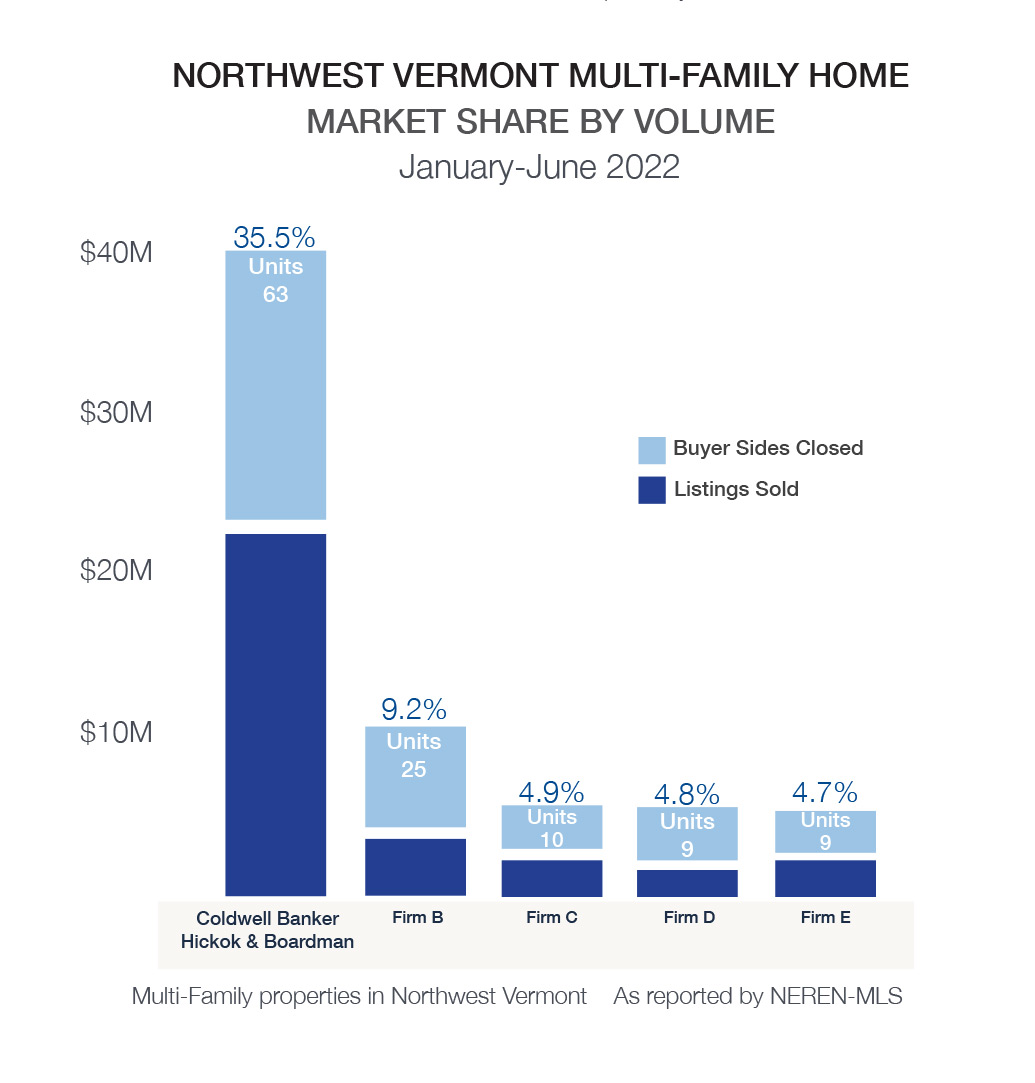

The multi-family market continues to provide purchasers a more predictable investment opportunity vs. the stock market and other more volatile options. In the first half of 2022, 82 units sold in Chittenden County at a median sale price of $522,500, representing a 6.5% increase over 2021. Most multi-family properties, and therefore transactions, are in Chittenden County.

Rental Market Update

Rental Market Update

In 2020, rents were held level by many landlords focused on tenant retention during the pandemic. Now, in 2022 based on market conditions and tenant demand, there is significant upward pressure on rents. From the Allen, Brooks & Minor June 2022 report, the average 1 bedroom rent is $1309/month; 2 bedroom rent is $1534; 3 bedroom rent is $2120. The average increase from 2021 was approximately 3.8%. That is likely to sustain or increase in 2022.

Chittenden County, home to most of the region’s rental units, has a historically low vacancy rate. In June 2022, the Allen, Brooks & Minor report recorded a new historic low of 0.4%. The deficient number of available properties puts pressure on tenants to find suitable homes, despite 451 new units coming to market in 2021. The last 10 years averaged 448 units per year.

The modest pace of new construction and population growth continues to pressure an already low vacancy rate. 520 new units are projected to come to market in 2022, located primarily in Burlington, Williston, South Burlington, and Essex/Essex Junction. Much more production is needed to significantly impact the challenging vacancy rate.