| Multi-Family January-December 2023 | |||

|---|---|---|---|

| Median Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

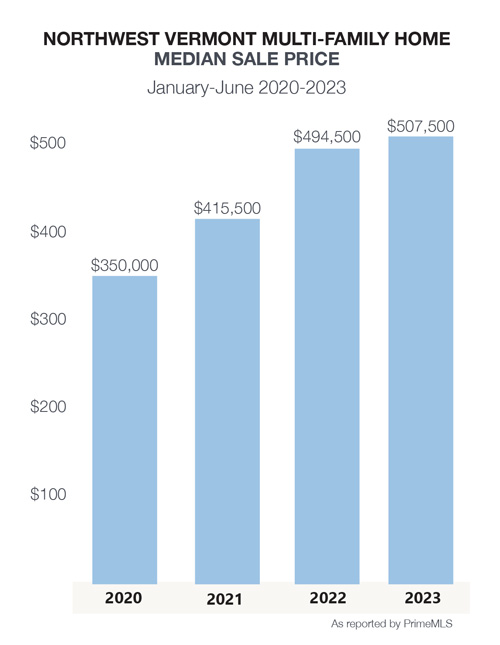

| $484,852 -1.1% | 118 -35.5% | 184 -10.2% | 49 -9.3% |

| Northwest Vermont | MEDIAN SALE PRICE | VS 2022 | UNITS SOLD | VS 2022 | NEWLY LISTED | VS 2022 | DAYS ON MARKET | VS 2022 |

|---|---|---|---|---|---|---|---|---|

| Chittenden County | $590,000 | 12.40% | 73 | -46.30% | $111 | -28.40% | 30 | -23.10% |

| Addison County | $391,500 | 25.30% | 16 | 0.00% | $18 | -14.30% | 133 | 22.00% |

| Franklin County | $285,000 | 10.50% | 29 | 3.60% | $53 | 103.90% | 52 | -49.50% |

Many real estate investors paused during 2023 as reflected in a 35% decline in properties sold and the minimal change in the median sale price. While residential property sales are largely driven by “life stages or life changes”, the purchases of multi-family and investment properties are driven by analytics. Higher mortgage interest rates adversely affected the purchase opportunities in the market. The number of multi-family units coming to market dropped 10%. These properties are a desirable property class in large part due to low vacancy rates, rising rents, steady appreciation, tax benefits, and a hedge against stock market fluctuations. Owners may be holding onto properties as they perceive a lack of alternative investment options and don’t want to give up their pre-2022, low mortgage rates.